Restoration Financing: Any time you simply take an in-domestic loan from your own restoration providers?

Share this post

Homeowners who possess currently borrowed up to the most restoration bank financing limitation out of $31,000, or people who don’t want to sign up for a supplementary mortgage, tends to be inclined to as an alternative need a call at-domestic mortgage offered by the inside design firm he’s engaged.

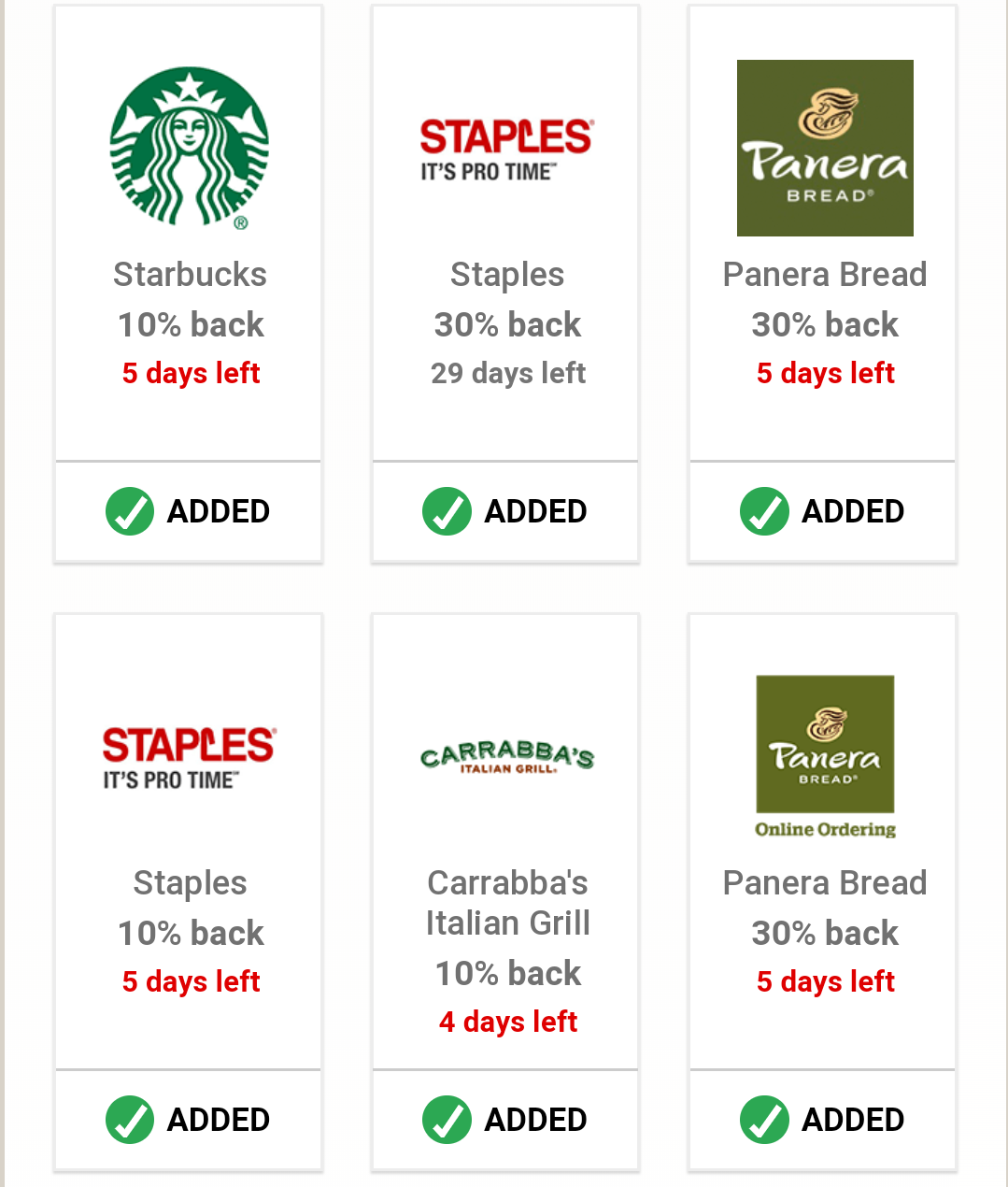

4 Recovery Organizations within-Family Mortgage

Although this may seem like a punctual and you will much easier solution within enough time, using up particularly that loan just to over your own home improvements may grow to be an awful idea.

In-family repair funds off interior decoration companies are not well-known, listed here are cuatro renovation businesses that promote within the-family restoration fund in the Singapore:

Must i get an out in-house financing off recovery business?

Be cautious and you may sensible in it pertains to taking any mortgage. Never to jump the gun, but, if you’re offered a call at-household restoration mortgage out of your interior designer, you should not take it right up if you do not have no most other choice. Here is why.

step one. In-mortgage loans is actually supported by licensed moneylender

To start with, let us get one issue upright. So you’re able to lawfully lend money in Singapore, entities need make an application for suitable licences. These types of licences are only booked for loan providers, such as for instance finance companies, boat loan companies and licensed moneylenders.

As such, interior decorating enterprises was unrealistic to get the best certification to give signature loans and their renovation functions. And for the rare couples who do, they are going to more than likely encourage both tracts regarding enterprises because the hey, its a new source of income, so why not?

In this case, how can design agencies give you a call at-home restoration loan? The most appropriate response is that they spouse up with an effective lender, one that’s licensed so you can give signature loans toward social.

You’ll be able to one to an internal structure company get mate right up with a lender provide their repair loan packages in order to readers however, if discover people available, i have not been aware of all of them.

not, it is inclined the group offering the mortgage is a licensed moneylender. Considering how extremely competitive the new signed up moneylending marketplace is, it’s not hard to thought moneylenders partnering up https://paydayloanalabama.com/rockville/ with design firms as a way to started to a lot more potential prospects.

dos. High rates

There is nothing completely wrong together with your indoor creator providing a loan off a licensed moneylender by itself, provided the fresh moneylender is actually properly authorized along with a great reputation, you can be assured of a professional and you may over-panel experience.

The problem is that rate of interest charged by the subscribed moneylenders is a lot more than those people charged by the banking companies and boat finance companies in some instances, with ease outstripping their credit card rates of interest!

You should know that authorized moneylenders can charges attention of up to 4% 30 days compared to the lender repair financing that go to have between 3.2% so you’re able to 4.55% per year.

Let me reveal an easy review anywhere between a licensed moneylender mortgage and you can an excellent financial restoration mortgage, with the particular providers’ on line hand calculators.

Indoor Creator In-House Recovery Financing

This must not be stunning, offered how good-offered industry are, which have numerous bank and you will boat loan companies providing well valued restoration money here.

Make an application for Renovation Financing in Singapore

Regardless of where you’re taking the renovation loan off – financial, signed up moneylender, or their repair providers – you really need to watch out for next in relation to a remodelling mortgage provide.

step one. Rate of interest

Because there is depicted a lot more than, the rate towards a restoration financing (or almost any borrowing, for that matter) ‘s the solitary most important factor.

That loan with high interest rate is more difficult to repay, plus a performance that’s simply quite highest can be change to a distinction in the money words.

2. Mortgage period

Loan period basically refers to the day you need to pay right back the loan. Finance companies typically leave you step one in order to 5 years on how to pay back your recovery mortgage. This enables that give the debt out, ultimately causing down monthly costs which might be simpler to do.

Although not, remember that the newest extended you’re taking to spend back, the more month-to-month interest you are going to need to shell out as a whole. However, it is far better to decide an extended period in order to not overburden on your own.

Many licensed moneylenders is actually unwilling to expand financing tenure longer than simply 1 year, so that your repair financing month-to-month repayments are going to be very higher maybe even larger than you could potentially conveniently pay for.

Today, if you feel that brand new monthly installments to suit your recovery financing is too large, do not need one to renovation mortgage, since you run the risk of falling on a personal debt pitfall, rather than-finish punishment fees.

My interior creator provided me an out in-house restoration mortgage. What you should do?

On the uncommon options their indoor designer provides you with a call at-domestic recovery loan, be sure to very carefully research the newest fine print of financing, particularly the interest and mortgage period.

In case the financial is an excellent moneylender, you may want to see the Ministry out of Law’s specialized set of registered moneylenders. Make sure that the latest moneylender is not suspended otherwise blacklisted.

While you are becoming told the into the-domestic financing is out there from the a lender, do not just take your indoor designer’s keyword for this. By themselves check with the bank under consideration, and make sure the rate, tenure, charges and you will fees, and other conditions and terms are exactly the same.

But such as for instance i said, in-family repair financing are not very common for the Singapore, so your likelihood of encountering you’re probably be reasonable.