An educated mortgage having a property would be to earn try a keen FHA mortgage when you yourself have a woeful credit get

A few of the very first time homebuyers tend to believe that they commonly eligible for the FHA loan however, actually he’s the possibility to get it too. The lowest borrowing requirements to have FHA fund, also known as crappy lenders, are part of one home loan.

The financial institution have to have a minimum credit history out of five hundred which have a percentage out-of ten upward alterations so that the brand new FHA to guarantee a mortgage. It is yet not very difficult, even if you try ten percent off, locate cashadvanceamerica.net pre approved installment loans a credit score to own an FHA financial for the the variety of 500-579. You must stick to the guidelines given in this post to increase the mortgage before you apply for a beneficial hypothecary.

You simply you want a share out-of step three.5 down payment if you have 580 otherwise all the way down Fico scores. It is way less likely that their dimensions could well be lower than 580 to be recognized to your FHA mortgage loans with an effective 580 + rating. Get some good details about CREDAI registration in the a property .

Authorities Covered v/s Antique

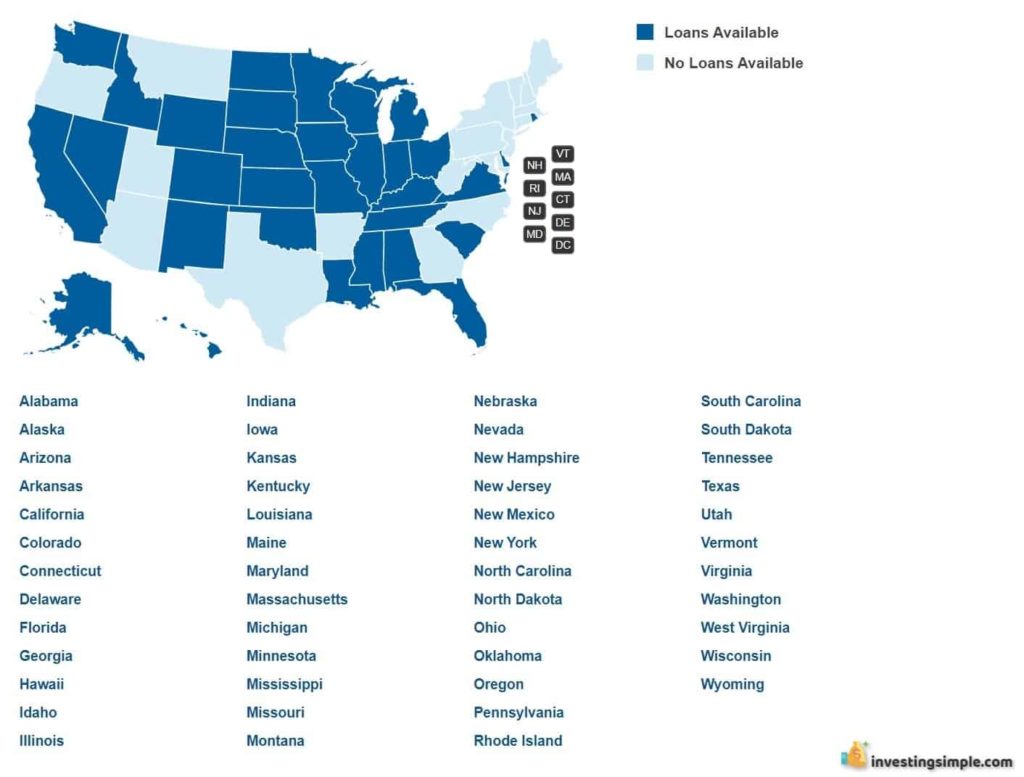

Government-insured financing usually have additional constraints. Someplace else, the area in your geographical area, such as for instance, you may not have the ability to get an excellent-cheap house. Also, when you have a negative otherwise a short mortgage list, or you can maybe not save so you can 20% of the appeal, such loans are simpler to obtain. Getting consumers while the cost savings, owning a home is essential. But really home loan financing is tremendous and risky. Therefore, in general to your riskier lenders, new federation has had action to safeguard men and women types of mortgages. A government-insured loan may be your own sole option if you have an effective down credit rating otherwise income. Plus, realize homes dimension products inside the Kerala

Antique Credit/Mortgage

The most famous selection for buyers is a classic mortgage today. Its sold from the personal lenders instead of from the an authorities company. These represent the loans you’ll be making an application for at the financial or borrowing from the bank union. Many typical finance want a lot more credit scores (620 or maybe more) than many other particular money. In addition, old-fashioned fund will vary much more amongst the consumers and the lenders and you will private companies normally view solution investment. This might allow you to see less than most useful allowed. Here are a few particular home loan procedure during the India .

Exactly what do You are doing in the event your Financing is simply too Reasonable?

Whenever you are you will find above an effective way to safe a bad credit mortgage, you do not have the ability to save your month-to-month home loan because the you are not allowed to collect a down-payment. You should take time to spend less and hold the absolute best interest. You may want to create discounts in your deposit to switch their borrowing to improve your approval ventures on a reduced price.

We recommend that to make contact with the newest customer’s agent prior to beginning the business if you’re ready to pick capital selection. A representative usually assist you through the full to invest in techniques and help you answer people funding concerns before starting. Client’s representatives may give economic recommendations and link your which have trustworthy loan providers and you can creditors. Really possessions managers/enterprises currently own their particular other sites, because when starting rules, setting up potential tenants and users, they are aware of one’s property value these sites and you may close arrangements together. And discover popular real esate myths .

You aren’t Planning Spend less, Do not think Thus.

You can easily believe that a modest loan might possibly be less expensive than the month-to-month book if you have rented chock-full of your neighborhood. Sure your own mortgage repayment is more affordable than just the rent. Nevertheless, this does not indicate one to owning a home is actually cheaper than book.