There are numerous financing networks that offer some financing choices for renovations, plus Hitch

You will need to examine this new cost, terms, charge, and you may qualifications requirements various loan providers to discover the best match to suit your specific needs.

Are you presently buying a great fixer-higher?

You may want to consider FHA 203k. Additionally it is really the only loan i number which provides renovations which is often shared towards a beneficial homebuyer financial. You will want to read the assistance observe if you understand the laws and regulations ruling financing disbursements. The thought of buying one home to safeguards the 2 you prefer is decreased and eventually simpler. Meyer demonstrates to you you to FHA203k applications are only helpful when buying fixes. I might still highly recommend home owners have a look at choice loan choices.

Playing with domestic collateral to your low-house costs

If you’re moving money from a bank to a finances-away financial or home loan to a property security mortgage, the bucks goes to virtually any count need. You can pay-off credit card bills, buy a car or truck, pay personal credit card debt and you may carry on a secondary. What exactly do we are in need of? You have decided; which is your very own. However, investing guarantee inside the improving your home is usually an excellent way of boosting your home’s worth. Purchasing $4000 in order to redesign a cellar is a fantastic financing within the improving good household’s worthy of. This is an extremely rewarding money with your residence.

Complete the loan application techniques

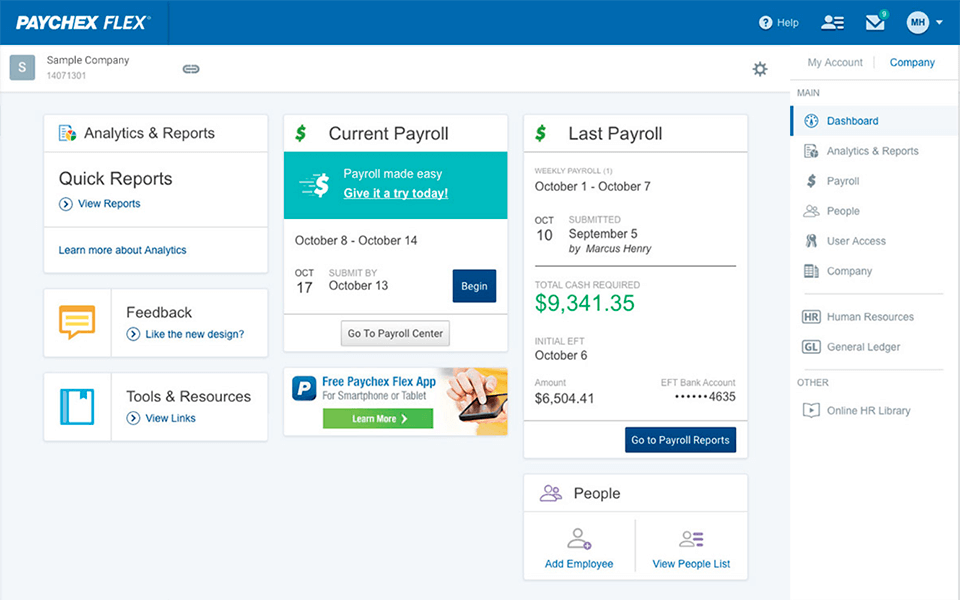

You may also submit on the web applications to own funds of the phone, because of the mail otherwise by the contacting your regional bank yourself in case the lender doesn’t deal with them in person. Both your own mortgage app range from one another solutions. Your own credit company get comment your application to really get your property examined centered on financing terms. You’ll be acknowledged to have funding when you yourself have an effective ount out of currency to pay.

While searching for a property improvement loan, consider using Hitch to help you clarify the borrowed funds app techniques. Hitch now offers a sleek software process that shall be completed entirely on the internet. That have a network of legitimate loan providers and multiple loan alternatives, Hitch helps you find the best mortgage for your specific home improvement need https://paydayloancolorado.net/bonanza-mountain-estates/. Also, Hitch even offers individualized service and you can information regarding the entire process, making sure you really have every piece of information you need to build a knowledgeable choice for the unique situation. Initiate your home update loan application with Hitch today to come across exactly how easy it could be to find the funds you prefer to switch your home.

Related Articles:

- How exactly to discover your guarantee in a changing housing industry

- Home improvements, building work, and you will enhancements finance calculator

- Toilet Remodeling: Suggestions, Tips and tricks

- Tips Funds Base Solutions

- Get a hold of Home improvement Finance for the Oregon

- Investment The Tx Renovations: The basics of Home improvement Loans

- Home improvement Funds for the Las vegas: What you need to Learn

2. HELOCs enjoys a good ten-year draw period. For the mark several months, the newest borrower is required to create month-to-month minimum payments, that can equivalent more of (a) $100; or (b) the full of all accumulated financing charges or any other charges for the monthly billing duration. When you look at the draw months, the month-to-month minimal payments might not slow down the a great dominant harmony. In installment months, the newest borrower is needed to build month-to-month lowest payments, that equivalent more off (a) $100; otherwise (b) 1/240th of one’s a fantastic harmony after the fresh draw period, along with all accumulated fund charges or other costs, charges, and you may will cost you. When you look at the cost months, brand new monthly minimum payments may not, on the the amount let by-law, totally repay the primary balance outstanding towards the HELOC. At the conclusion of the fees period, the latest debtor must pay any remaining a great balance in one single full commission.