How to automate accounting processes Step-by-step guide

If you don’t know how to start a sales cadence, Instantly has you covered. With the AI Sequence Generator, you can create entire campaigns with a few clicks and prompts. Leverage the technology filter to target companies using specific tech stacks.

Although it’s possible to handle each incoming invoice or bill manually, automation tools reduce the tedious steps involved in the AP process. Accounting software and financial platforms can catch mistakes and errors, which ensures more accurate record-keeping. Automation allows redirecting the hours previously spent on data entry, reconciliations, and report generation to more strategic endeavors that drive growth. It enhances productivity and fosters a more fulfilling work environment by allowing employees to engage in higher-value activities. With automated systems handling repetitive processes, accountants can dive into the intricacies of financial analysis. Armed with real-time and accurate insights, they play a pivotal role in guiding business decisions, identifying trends, and offering actionable recommendations for growth.

- Another type of email you can automate is surveys, especially for businesses in the service industry like contractors where reviews mean everything.

- This means that repetitive tasks like data entry and checking calculations are taken care of, so accounting professionals can focus on big-picture duties.

- Businesses can automate their tax preparation process, starting with high-volume, high-return tasks like report generation, data collection, and validation.

- The origins of accounting automation can be traced back to the late 20th century when businesses began adopting computers to handle financial calculations and record-keeping.

- Humans are necessary for critical thinking and decision-making in accounting.

Manual data entry can be rife with errors, especially when recording a large number of transactions all at once. By integrating your accounting software with other tools, data can be automatically updated, ensuring that it is recorded correctly. Automated accounting systems provide a centralized location for all your financial documents and data. With everything stored digitally, you can easily find what you need when you need it, improving efficiency and reducing the risk of lost or misplaced documents. Automated accounting facilitates everyday accounting practices, dramatically increasing the functionality of these programs. By leveraging artificial intelligence and other sophisticated functions, accounting software can do everything from tracking and recording transactions to generating financial statements.

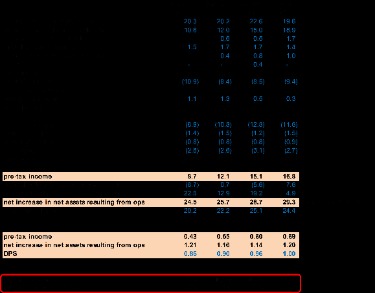

stages of accounting process automation

This seamless connectivity empowers businesses to operate efficiently in the global arena. Turning accounting into a single source of truth allows for advanced forecasting and scenario planning. By leveraging historical financial data, operational metrics, and market trends, businesses can create sophisticated models for projecting future outcomes. These predictive capabilities enable proactive resource allocation, risk assessment, and scenario planning, enhancing strategic decision-making in a rapidly changing business landscape.

The origins of accounting automation can be traced back to the late 20th century when businesses began adopting computers to handle financial calculations what is a bad debt ratio for a business and record-keeping. It marked the initial steps towards automating repetitive tasks, liberating accountants from the confines of manual ledger entries and calculations. With time, the evolution of technology gave birth to more sophisticated accounting software and systems, propelling accounting automation into a new era. Some accounting automation software can introduce unnecessary complexities into financial processes.

Streamline your order-to-cash operations with HighRadius!

You have the information you need, without needing to pull reports over and over again. Once you have your workflow set up, give it a quick test run to ensure it’s working the way it should. That’ll give you some added peace of mind when you step away and let that automated process run on its own. Those different approaches and perspectives don’t cause any snags when you automate accounting and finance processes. Use the software’s features to set up reminders for recurring invoice template for sole traders tasks like sending invoices or paying bills. Automation software is responsible for automatically completing tasks such as bookkeeping and accounting.

Exploring key automation technologies in accounting

Throughout an automated accounting lifecycle, users might find module navigation technical and complex. All seller’s net sheets data points and features must appear in a central and easy-to-access area. The more user-friendly it is, the less the learning curve will be for your team. The next step is seeking the best automation solutions for your business’s financial framework.

What are some examples of accounting process workflows?

That’s proof that it’s important to stay on top of the money your business is owed from your customers. With those predefined steps in place, those accounting practices are happening reliably and are done the same way across all of your departments, tasks, team members, or customers. Accounting automation is a specific subset of process automation, which continues to gain steam among companies and business owners.