Do you know the costs from refinancing your property loan?

Refinancing can potentially help you save plenty on your mortgage, however, there are also costs that come with performing this.

Refinancing could easily save thousands in your mortgage. If you’re considering refinancing, you are probably concerned about getting a lowered rate of interest. It is necessary regardless of if in order to along with make up all of the most other will cost you out-of refinancing a home loan.

As to the reasons re-finance?

Refinancing a home loan happens when a debtor motions the mortgage from bank to some other. Once you re-finance, your generally undertake an alternative loan into leftover count you owe. In the event that, such as for example, you switch to an alternative financial, your financial will pay your bank the fresh new a good matter, you then pay-off your brand-new collector from the an alternative speed.

There are causes you might re-finance. Most common should be to make the most of a mortgage having a far more aggressive interest rate, but there are a variety off other people. Less than are a selection of a number of the typical aim to have refinancing:

- For those who have collected excessively collateral for the your house, you may be capable re-finance and take away a larger contribution, that you could fool around with for home improvements if not almost every other highest expenditures particularly a vacation.

- As an alternative, you could potentially refinance and take aside more substantial matter you next may use to help you consolidate costs, out of playing cards otherwise unsecured loans, eg.

- For those who have split from the companion the person you co borrowed with, you’ll want to re-finance to take command over the house mortgage on your own. Most banking institutions does not allow you to merely beat a good co borrower.

Style of costs you’ll shell out

There are certain upfront charge which come that have refinancing, but not, such charge and exactly how much they costs differ ranging from each bank.

It is very important take the price of such fees into consideration when refinancing and also evaluate ongoing can cost you. Some loan providers might have high lingering can cost you however, hardly any initial will set you back. When you use with the initial costs are low, and you can never be charged people month-to-month charge.

Launch percentage

When making your existing financial, there is a lot regarding really works you to definitely gets into in order to preparing and you can control the discharge of financial. Of a lot lenders usually fees release charge, such a discharge government percentage, paperwork fee, if you don’t money broker payment. Definitely look at the financing offer to confirm exactly what attempt to shell out.

Split fees

A fixed-speed home loan function you are going to protected your rate of interest for a period, typically one 5 years. For many who re-finance contained in this fixed several months you will need to spend break charges, to afford losings the lender can experience this is why of one’s mortgage perhaps not running toward in the first place assented title. Break costs are going to be advanced so you’re able to estimate making it really worth contacting your payday loans Saguache own bank to ask for a price from just how much it could be if you choose to re-finance. Split fees are very expensive, so much so one sometimes it is necessary you own of refinancing.

Software charges

When you find yourself switching mortgage brokers to another to help you an excellent this new bank, you happen to be charged a loan application commission, also known as a business, set-upwards, otherwise start-right up payment. This is certainly a-one-date payment billed to pay for cost of running and you will files of one’s home loan.

Loan providers home loan insurance policies (LMI) are billed once you obtain more 80% of an excellent property’s value from a loan provider. For folks who haven’t accumulated enough equity of your home or the house or property enjoys fell from inside the really worth, you might have to spend LMI when refinancing. LMI is also tray up with the thousands and you may borrowing extra money function possible shell out significantly more for the interest across the lifetime of one’s loan, so how you’ll its required you avoid paying LMI.

Protection comparison commission

A home loan was secure resistant to the value of the house around home loan. Hence, loan providers commonly typically wanted a property to get valued in advance of giving your having refinancing, so they understand the worth of their cover.. The expense of that it hinges on the financial institution additionally the location of your house. Places usually are less to help you well worth, considering he or she is generally more accessible than just outlying portion.

Settlement payment

Funds fee was paid towards the the latest financial to repay your loan. They covers the price of the lending company arranging the mortgage settlement.

Identity look percentage

After you refinance, your brand-new lender needs to verify that you’re holder of your home. Just be sure to outlay cash a title look commission, that they will give on the related county otherwise area power to check this.

Is refinancing worth it?

When you find yourself given refinancing, you need to consider the experts and you may costs of doing thus. Like, you will probably find a product having a slightly down interest rate than simply your mortgage, however, by the point you factor in the newest relevant of your own significantly more than costs, you will probably find you would indeed feel using more you was in fact in the first place. It’s always smart to manage the fresh new quantity more than the whole mortgage name, and come up with whether refinancing makes you into the a much better reputation.

Just like the home financing manager, try to keep yourself up-to-date with their refinancing choice. We recommend evaluating the loan about all one year so you can find out if you have the greatest rates you are able to. They never ever affects to browse as much as and determine what type of contract you should buy someplace else.

Refinancing which have

Refinancing is approximately investing less cash on your own mortgage. Allows say you really have $350,000 however to pay on your mortgage more than two decades, during the an interest rate away from eight%. For many who refinance and switch your home loan so you’re able to is the reason Wise Enhancer Financial, in the an adjustable 5.1% desire r ate (correct given that in the tenth ) you will be able to cut back to help you $ninety five,237 in focus over the longevity of your loan. Might likewise have access to unlimited redraws, endless a lot more money, and you can pay no constant charge.

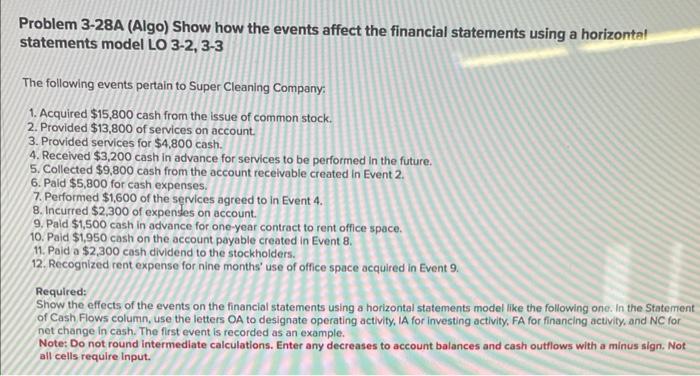

Why don’t we view several scenarios observe exactly how much you could conserve because of the using this mortgage.