Most readily useful Financing for Home improvement | 2022

Whenever tackling a house renovation, the costs accumulates quickly. An obviously short kitchen area redesign can be make you to your connect to possess several thousand dollars.

The best financing produces otherwise crack your residence home improvements. Whether you are shopping for a specialist home improvement mortgage for a particular kind of restoration otherwise a broad financing that may be employed to loans so much more general household improvements, you’ll find a good amount of options to select from.

What is actually a house improvement loan?

A property improve mortgage are any sort of loan that provides the funds you will want to maintain, resolve, or replace your domestic.

Often, do it yourself loans are unsecured personal loans which might be marketed to be having home improvement. There are also certain specific niche home loan items intended to be used in certain types of household renovations.

Obviously, when searching for a way to finance renovations, you are not limited to financing specifically designed for this purpose.

In fact, there are certain cash-away otherwise house security loan items to pick from, which allow that availability bucks from your home security to own people objective payday loan Mountain View Acres, in addition to to pay for cost of improvements to your residence.

How does a home update mortgage functions?

For people looking to funds family repairs otherwise developments which have a good shielded loan – both a finances-out re-finance otherwise an additional financial – you’ll need to complete a number of the same steps which were you’ll need for their modern domestic get application for the loan. Below, we shall give an explanation for practical differences between an earnings-away re-finance, a property collateral loan, and you can a property equity credit line (HELOC).

This type of mortgages want a full mortgage software, property appraisal, and you can settlement costs or fees. After you close the borrowed funds, you’re getting financing (or even in possible regarding an excellent HELOC, a personal line of credit ) that can be used the purpose.

To possess an enthusiastic unsecured consumer loan, you will never you need collateral in order to accomplish the borrowed funds. That means there is absolutely no home loan software or assessment; possible merely meet the requirements based on your borrowing from the bank and certainly will usually found finance faster. An everyday unsecured home improvement loan will come that have installments dispersed over that loan term. These types of financing normally have greater rates of interest than mortgage loans.

Do it yourself loans compared to guarantee financing: What’s the improvement?

The fund commonly offered just like the do it yourself finance are typically unsecured signature loans, and therefore they are a means to score dollars relatively quickly to own home improvements without the need for your property while the collateral. As they are unsecured, they often hold high interest rates and lower limitation financing number than just safeguarded loan options.

At exactly the same time, guarantee resource concerns with the collateral you have manufactured in the house just like the equity with the mortgage. Thereupon, you are getting your home on the line. If you can’t take care of the financing money away from good secured home improvement loan, your risk dropping your property.

Finally, if you choose an interest rate to fund the renovations, you’ll need to make sure you foundation settlement costs into the funds – and this normally include from around 2 in order to 5 per cent of amount borrowed for the total cost of one’s mortgage (even though this will usually be included in the mortgage matter).

Ideas on how to money home improvements

While looking for an effective way to finance renovations, you have many choices. But you will need certainly to choose which financing option is best complement your finances.

step 1. Home security loan

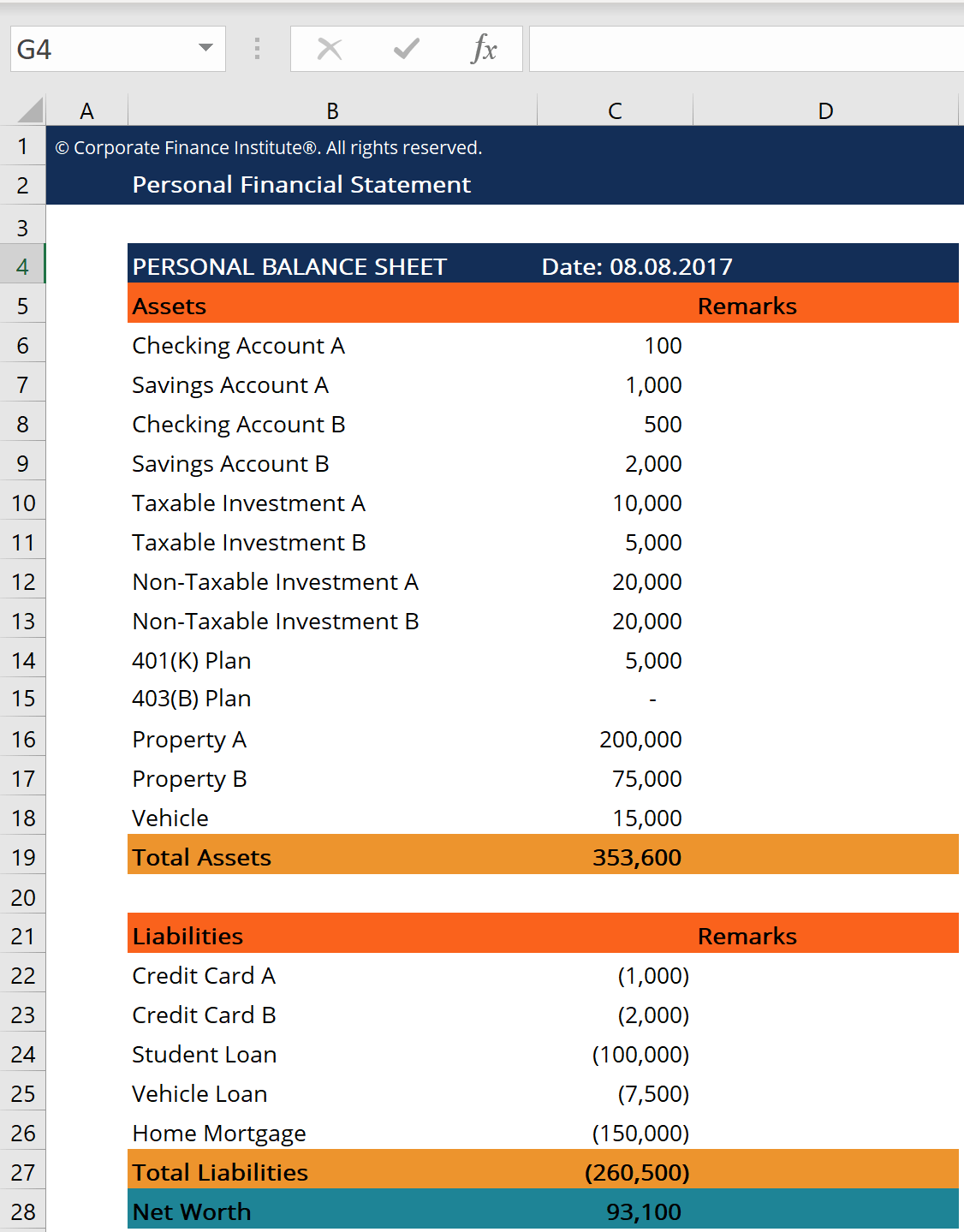

You can determine how much collateral you may have when you look at the a house because of the subtracting your own a good home loan harmony on the home’s value. Such, whether your residence is worth $100,000 along with an effective $20,100 home loan, then you have $80,000 in home security. Although, keep in mind that extremely lenders won’t allows you to borrow all collateral you’ve made in your house.