What are the Benefits associated with Bank Declaration Finance?

- A certain amount of dollars reserves in your lender, always numerous months’ worth of home loan repayments.

The actual criteria are very different regarding lender so you’re able to bank. Make sure to remark this new fine print when it comes to lender statement mortgage carefully prior to signing.

As you you’ll expect, lender statement funds has several significant professionals that produce all of them attractive tools to have residential home people, small businesses, plus.

- Lightweight documents standards

- Fool around with several to help you couple of years out of lender comments

- Put only ten% down

- Large financing restrictions

Lighter Documents Requirements

For starters, the main advantageous asset of a financial declaration mortgage are the light documents criteria. To be considered, it’s not necessary to has actually evidence of work of the an enormous team, nor would you like to give tax returns.

Providing you has proof earnings and you can a great deal of bank comments, you could likely get approved to possess a financial statement mortgage having installment loans in Kentucky an elementary domestic or commercial real estate property. To phrase it differently, cash is the limiting basis, perhaps not your write-ups.

Have fun with a dozen to help you a couple of years off Financial Statements

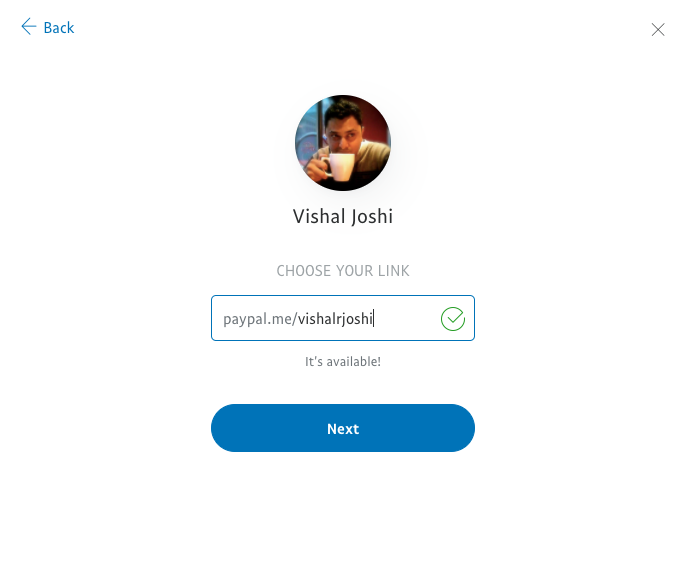

In place of records particularly taxation statements otherwise W-2s, financial report loans only require a dozen in order to 24 months from financial comments also a number of almost every other data files. You are able to retrieve this type of from your lender or print them away your self of the opening their bank’s records on the internet. This is exactly best for those with self-work earnings and other nontraditional different income.

Lay As little as 10% Off

Particular lender declaration money require that you lay just 10% down unlike a higher 20% otherwise 29% deposit. This can guarantee that properties a lot more accessible to borrowers otherwise traders, especially those seeking build their portfolios away from abrasion.

Large Loan Restrictions

Lastly, of many financial declaration funds render relatively highest financing restrictions. These types of expand your to buy energy that can enable you to buy features who otherwise become out of your monetary come to.

What are the Drawbacks away from Lender Report Funds?

But not, whether or not bank statement finance have several advantages, there are many drawbacks to remember. These drawbacks tend to be:

- Higher interest levels

- Large advance payment if the credit rating try low

- Need to be mind-useful for a couple of years

- Maybe not provided by most of the lenders

Highest Rates

For starters, bank report loans appear to costs highest rates. After all, the lending company otherwise bank under consideration is actually taking on additional chance from the financing you currency rather than W-2s, tax forms, and other support documentation.

Need a high Down payment

While some bank statement financing has low-down fee requirements, anyone else might have greater down payment conditions – as much as 35% or more.

Once again, all this relates to the lending company concerned; particular finance companies be a little more chance-averse and want highest off payments so you can offset the high seen chance.

Should be Care about-Used for Two years

If you try to obtain a financial report mortgage once the a personal-working personal or contractor, needed couple of years regarding worry about-employed background to qualify for extremely deals. This proves that your mind-operating organization is steady and this the lending company can be count on one make your percentage every charging years.

Maybe not Offered by Every Loan providers

The final potential downside to bank statement financing is you can’t find them at each lender. Just a few lenders render lender report loans whatsoever, as well as fewer give large-high quality lender declaration loans that have accessible terms and conditions and lower certification criteria. For this reason, you may have to search for a bit to discover the right bank declaration loan to your requirements.