12 Affairs to stop Before Closure on the Home mortgage

You become the process to purchasing a property. You’ve met the financial and then have been preapproved. You picked property therefore the merchant provides acknowledged the offer. You might be well on your way in order to residing in the new domestic truth be told there can not be numerous difficulties, best?

Commonly, this will be real. Although not, when monetary circumstances changes between your go out youre pre-accepted for a financial loan therefore the date you technically personal on the the loan, the path to purchasing a property is slowed down otherwise completely derailed. For this reason it is critical to make sure that you’ll find zero major transform to your earnings during this time period.

End Obtaining Almost every other Fund

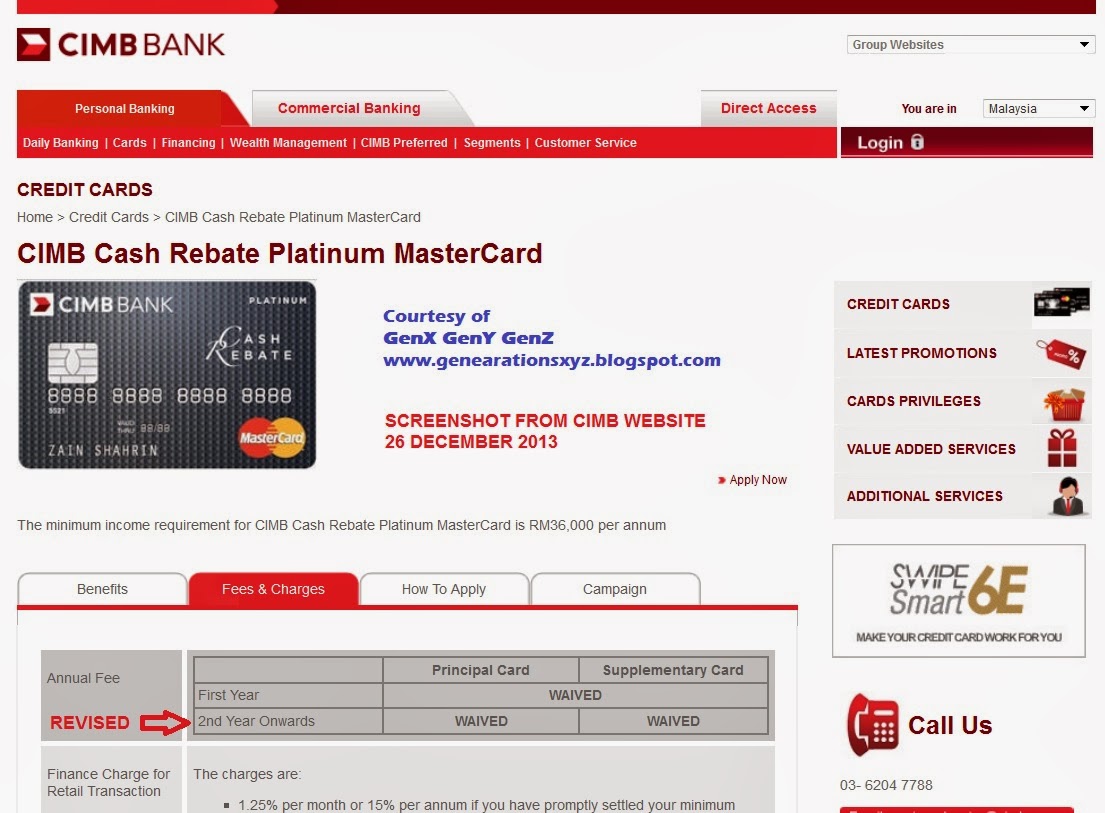

You need to end applying for almost every other loans (as well as cash advance), beginning a unique personal line of credit (instance a charge card), if not cosigning toward that loan. Many of these circumstances can look on your credit file. Their financial can find the rise with debt and you can requisite monthly payments. They may determine that your capability to generate payments on your own fresh mortgage consult has evolved.

The above mentioned points often connect with your credit rating. However they need people to focus on a credit assessment for you, hence step in itself can even affect your credit score. Because your credit history identifies your mortgage price or if you are eligible for a financial loan, it’s best to help save these types of change having later on.

Avoid Late Money

This can both change your credit score and gives very important research towards the lender that you can while making costs. Believe making automated payments.

End To shop for Larger-Citation Points.

You ought to stop tips that could notably elizabeth. It means waiting to pick huge-solution activities such as for instance a motor vehicle, motorboat, or seats up to after you’ve entirely signed on your home loan mortgage.

To avoid Closure Lines of credit and And make Higher Bucks Deposits

You would imagine closure a charge card otherwise transferring a large amount of money would work on your side. However, closing a personal line of credit for example a charge card your suspected it influences your credit rating. Even though you avoid the credit card, research it is present, therefore have not used it irresponsibly can benefit you.

While doing so, an enormous, unusual bucks put looks doubtful. It will require a lender doing look into the whether or not the financing are a loan provided by a buddy or if perhaps this new unexpected improve is also genuine.

End Modifying Your job

Quitting otherwise switching operate may suggest a general change in income. To possess most useful otherwise even worse, the alteration have a tendency to impression the financial application. Save your self so it lifetime transform to own after you’ve signed with the mortgage, otherwise at least, reach out to the financial to talk about just how so it change you can expect to affect your loan.

Prevent Almost every other Big Financial Transform

Now is perhaps not committed to change banking institutions. In such a circumstance, the bank would need to decrease the mortgage techniques so that they’re able to gather one particular current papers from the the fresh bank.

Keep Bank Informed out of Inevitable Life Transform

Such as, if you plan to acquire married inside mortgage processes, make sure that your financial knows. Why? Your lady would need to sign the borrowed funds, whether or not they may not be an element of the loan.

If you intend to lawfully change your term, its also wise to hold back until after you have signed to your mortgage. The new discrepancy from inside the labels to the some other data files you can expect to slow down the process.

Keep in touch with your own Financial or Agent

Even though the above may seem like a lot, referring to simply to stop people major economic transform until after you have closed in your mortgage. If you find yourself not knowing, ask your lender before acting.