Resource An enthusiastic Rv 101: Loans, Credit ratings & Buying your Fantasy Camper

Understand the subtleties away from funding your brand-new or used campervan, motorhome or travelling trailer

Funding. The expression may sound overwhelming or leave you which have a sense out-of worry when the time comes to determine whether or not your can afford one the or used rv van, motorhome otherwise traveling truck. However with ideal broker, there can be practically nothing to concern.

Buying your dream rv van otherwise take a trip vehicles to begin the vanlife travels is a huge action, and several rigs are going to be expensive. People say the biggest purchase a person helps make within their existence is the household, accompanied by its automobile. Just like the a property into the wheels, motorhomes, RVs and you may campervans fall somewhere in between. Actually, some new RVs could cost around a tiny household!

Before you take the fresh dive thereon rig, i encourage calling nearby lender and you will talking-to a monetary pro regarding your alternatives and funds. Needless to say, your own lender is not necessarily the only option readily available for protecting an enthusiastic Rv fast cash loan Carolina AL financing. Rv dealerships, online loan providers and you can credit unions also seem to bring finance.

There are even many loan providers inside North america that focus on Camper capital, particularly Camping World, An effective Sam, LightStream and you may GreatRVLoan. Because these loan providers priper, motorhome fund and Camper, you are able to safe a lengthier financial support term and you can top rates.

What’s a keen Rv loan?

An Camper financing is a lot like a traditional auto loan, however the loan percentage stage may be extended like good financial (mortgage)-around fifteen years, whereas really auto loans was between 5-eight age. Additionally, it is you’ll-depending on the establishment and how pricey the brand new rig you’re looking purchasing is-that you may have the ability to safer funding getting a term regarding twenty years.

While you are an Rv mortgage is much like a car loan inside the its earliest design, a keen Rv loan might have a bit more difficulty so you can it, maybe not rather than providing property mortgage. Camper fund are typically on the latest and put models, and also the financing are going to be for as low as $5,000 or the whole way as much as more than $one million.

Just remember that , of many establishments doesn’t allows you to loans an Rv which is over 10 or twelve years of age. When your rig you prefer was over the age of you to, you might need lay out more substantial down payment so you’re able to secure that loan.

If you are ready to get resource, possible probably end up being facing an alternative ranging from an enthusiastic unsecured consumer loan or a protected automobile financing. An unsecured loan means their Rv may not be repossessed for people who be unable to make costs, whereas a guaranteed loan results in your Camper is repossessed if you cannot create repayments. Secured finance can be essential for everyone having less credit rating.

Just what guidance you’ll need to sign up for a keen Camper mortgage

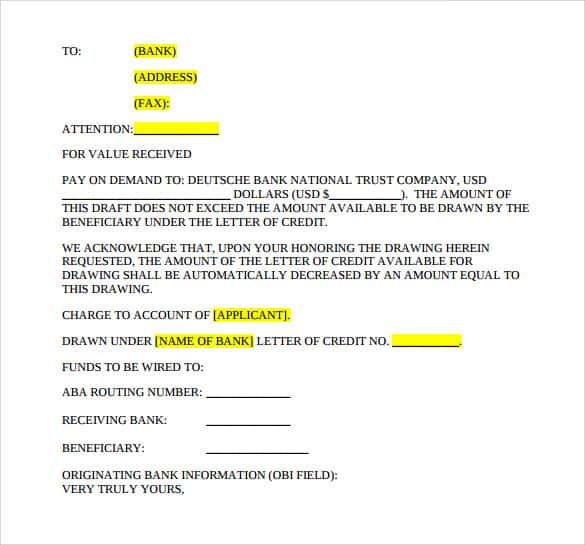

If you choose to follow a keen Rv financing, make an effort to get particular data files and you may files able to possess the financial institution to examine. For example, your financial statements, pay stubs, tax statements and outlined credit history will the likely be factored into your mortgage eligibility. you will probably be asked for information about this Rv you are interested in to get, like the 12 months, create and model, while the car identification count (VIN).

The loan team will likely work on your credit rating. A good get so you can secure a typical auto loan is generally around 670 or even more, but for a more impressive admission items such a keen Rv you really must have a credit history with a minimum of 700.

You shouldn’t be shocked whether your lending institution requires an examination out-of the new Rv, that will cost you from $100 to around $step 1,000. It is additionally vital to note that not all the lenders usually fund most of the sort of relaxation vehicles. Specific lenders won’t provide getting travel trailers, while some won’t provide having vintage Volkswagen camper vehicles. You ought to check on you to in advance of settling on a loan provider.

Already, Camper rates try between 4 and you can twelve per cent, even if which may vary according to where you happen to live and exactly how a their credit is. The better your credit score, the higher-or straight down-the rate a loan company is likely to give you. When you yourself have a dismal credit score (like less than 570), you will be thinking about mortgage towards the highest avoid of assortment in the list above.

Tips and pressures out-of resource a keen Rv, motorhome or campervan

Now that you understand what an enthusiastic Rv loan is actually and exactly how to apply, let’s target the average demands and gives some suggestions so you’re able to protecting financing having a unique or utilized Rv.

To begin with you should perform was decide on good funds. Estimate a month-to-month number you might easily manage and you can invest in expenses. (You don’t want to feel Rv worst.) And additionally, take into account the cost of Rv insurance rates. If you’re looking to financing to help with resource, you may be expected to have insurance policies, also, so make sure you factor that monthly prices into the budget.

While you’re wanting your perfect rig, initiate rescuing a hefty deposit. Specific loan providers have a tendency to request at least ten percent off, but the majority will want at least 20 percent down.

In the event your credit score must be increased, talk with their lender otherwise economic coordinator regarding entering an application to compliment your credit rating.

Another touchy subject the majority of people bashful out of are discussing brand new cost of the newest Rv, and even negotiating with a loan provider having quite top cost. Thought searching for wiggle room in both the fresh Camper rates and financing words. It can’t hurt to ask and you may, in some cases, it’s questioned.

As an example, when you’re buying another rig, new supplier will get reduce the price because of the as much as 20 otherwise 30 percent from the manufacturer’s retail price (MSRP). Your very best possibility to have good price is actually into the camping offseason, regarding October so you’re able to March.

You may find you get a far greater package to the rig if you opt to money individually through the Camper agent, but just make certain you might be at ease with the loan rate becoming provided. Should you decide to live in the Rv, motorhome or campervan complete-date, you might need to talk with a taxation professional due to the fact it could be possible to enter off allowable financing focus.

Get Camper funding today

From the Vintage Vehicles, you can expect financing solutions into the the latest and used classification B RVs, motorhomes and you may campervans. If you are from the per van otherwise motorhome, see the current inventory and you can plan a customized trip of one’s parcel.

I and get made use of motorhomes and you may camper vehicles. So if you’re looking to share with, trade-during the otherwise change-right up, send us information on their rig.

We’ve been on the van to invest in-and-promoting organization for over thirty years and get for ages been a great family-possessed and you can run company.